After a long wait, the 2020/2021 Tyler Prize Awards for Environmental Achievement have finally been presented, having been postponed last year due to the pandemic. On June 3rd, in a virtual ceremony, Dr. Gretchen Daily and Pavan Sukhdev received their awards for estimating the values of ecosystems and quantifying the economic benefits of biodiversity. In accepting their medals, they joined a diverse group of women and men like Dr. Jane Goodall and Dr. Michael Mann who’ve received the prize, which rewards achievements in the fields of environmental policy, health, air and water pollution, ecosystems, biodiversity, and energy resources.

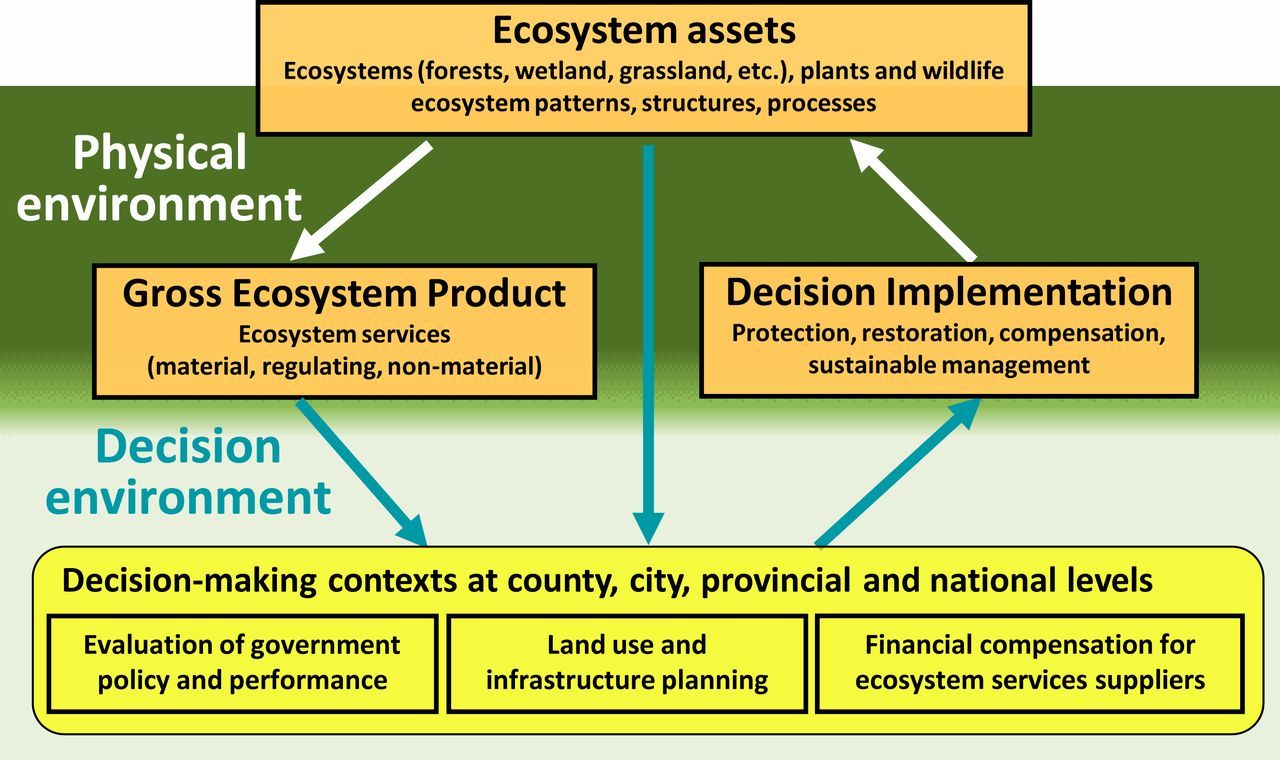

It’s well worth taking a deeper look at the ideas that link their work, and particularly the new metric introduced in March by the United Nations Statistical Commission – Gross Ecosystem Product (GEP). This metric, which is now being rolled out by the major development banks, seeks to accurately value the world’s ecosystems as a capital asset.

Together, the major development banks are responsible for $100 billion dollars’ worth of investments around the world, and taking the environmental impact of human development into consideration for these will be a great improvement over the current state; but it’s just a start.

Foreign Direct Investment overall was $859 billion in 2020 (down from $1.5 trillion in 2019) so it’s clear that private-sector investments have easily 8x – 15x greater impact on the environment than do projects funded by the big development banks. This is a key factor to consider because currently, the private sector is not required to use GEP, and it would take regulatory change to make that happen.

How Gross Ecosystem Product Works

So what is GEP, and would making its use mandatory across all sectors be enough to align modern economic systems with the environment in a mutually beneficial way going forward?

According to Dr. Daily, GEP does three things:

- It accounts for and reveals all of the benefits from nature to society; the sum total of all the goods and services that we get from ecosystems delivered to people.

- It informs investments so that wherever we live, we can understand where our day-to-day wellbeing comes from and make sure we're investing in maintaining that supply of goods and services from nature.

- It indicates whether the whole system is working to track progress and ensures that leaders and the policies that they're meant to implement are actually delivering what society needs.

Pavan Sukhdev, who spent over a decade working for Deutsche Bank and led the UN’s groundbreaking study on The Economics of Ecosystems and Biodiversity, agrees that GEP “is a very worthwhile way of looking at the value that nature delivers into the economy,” also noting that the UN has formalized a System of Environmental and Economic Accounts (SEAA) of which GEP is one component. So now, he says, “The excuses have run out.” There is no longer any reason for countries not to account for "the wear and tear of nature. The wear and tear of this huge capital asset that belongs to everybody and belongs to nobody. And gets neglected because there is no valuation."

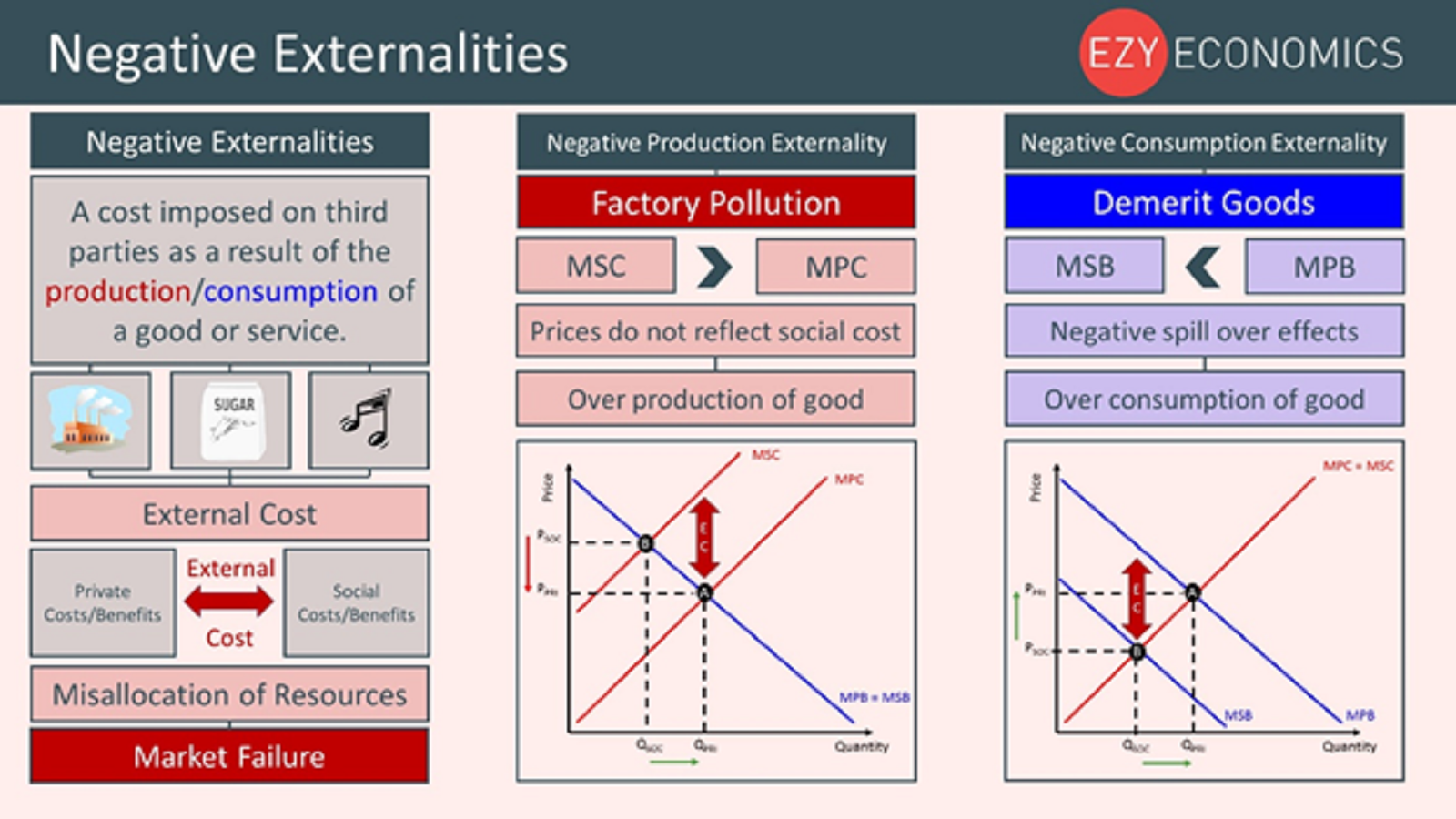

GEP gives a way for that valuation to occur; but that is only half of the equation. The other key thing that must happen is that we have to identify and pay for the “negative externalities” of the way we do business.

Pricing Negative Externalities

What's a negative externality? Mr. Sukhdev describes them this way:

The negative externalities generated by the private sector are now estimated to cost society over $11 trillion annually. That’s about 15% of the global gross domestic project, which Sukhdev says represents “the biggest free lunch in the history of the universe.”

But, he asks rhetorically, “can any free lunch last forever?” And his own answer is no. “Today’s externalities are tomorrow’s risks and the day after tomorrow’s losses,” he says, noting that the investment community is well aware of the problem.

Both of the Tyler Prize laureates agreed that corporations take a different view – “The way corporations are structured today makes me fear that they’ll never really change, that they’ll always be focused on profits first,” says Dr. Daily, with Mr. Sukhdev noting that, “In the case of the corporations, I’m sorry to say, it’s a free lunch, right? Why wouldn’t you keep enjoying your free lunch unless it stops?”

They highlight the need for government policies to force a change in how corporations account for the negative externalities that their products create, and one of the easiest ways to do that would be through taxation. As Sukhdev notes,

“Taxing the bads” would mean putting a tariff on the negative externalities; for example, if Coca-Cola wants to sell water in a single-use plastic bottle that has a negative environmental impact, the “bad” represented by the bottle should cost the company, and the consumer.

“When we do that,” says Sukhdev, “when we start taxing the bads and not taxing the goods, we will actually be addressing the problem of externalities by pushing economics in the direction of reducing those externalities, reducing those third-party costs.”

Dr. Daily suggests that land zoning represents another policy that can be used to “balance the books” with regards to GEP – and which is already being used effectively in some parts of the world. She notes that:

Some Other Thoughts on Valuing the Environment

All this makes sense, but there are other parts of valuing the environment that must be addressed. Award-winning science communicator Jayde Lovell observed that big corporations like Monsanto currently earn large sums of money for making very minor modifications to the genome of, for example, a corn plant. Those modifications represent less than 1% of the genome; the rest of the genetic code belongs to the ecosystem from which it originated. Therefore, it’s perfectly reasonable that Monsanto should retain 1% of all profits from sales of their genetically-modified seed – but 99% of those profits should go back to the original designer – Planet Earth.

And Mr. Sukdhev notes that there’s another side of the coin that needs to be addressed. He notes that massive sums of money are currently being invested in and spent on environmentally and socially destructive policies and initiatives, and he asks:

Where Do We Go from Here?

Its clear that the Tyler Prize has once again succeeded in highlighting environmental visionaries whose work has the potential to fundamentally transform the way we interact with the natural world, so where do we go from here? It’s great to see that the UN has taken the lead in adopting these measurement tools, and that the major development banks are incorporating them.

Now, it’s on us to call for our policy makers – our Presidents and Prime Ministers, our elected officials – to create the regulations that would require corporations to use these metrics as well. We must call upon them to “tax the bads” instead of, or at the very least, along with the “goods”.

We can also follow the guidance of Gandhi - “If you want to change the world, start with yourself.” Almost half of all greenhouse gases are produced by growing and transporting foods; so we can make a difference as individuals if we choose to eat meals that are more vegetable, more locally-grown, and have a lower pesticide and fertilizer input. That’s an action within immediate reach of all of us.

Did you like this story? Want to share your thoughts? Please drop your comments below!